What is Divergence?

Divergence occurs when the direction of the price and that of the indicator does not tally or match. This could occur in two ways:

- Positive divergence is a sign of higher price movement in the asset.

- Negative divergence signals that the asset price may drift lower.

What is Divergence Trading?

This trading is the type of trading strategy in which an investor looks for a discrepancy between the price of his security and an indicator such as a moving average, momentum or volume, the investor will then use this discrepancy to determine whether to buy or sell the security.

For example, if the price of a security is rising but the momentum indicator is decreasing, the investor may conclude that the securities overbought and may decide to send it. Conversely, if the price of the security is decreasing, but the momentum indicator is increasing, the investor may conclude that the securities oversold and decide to buy it.

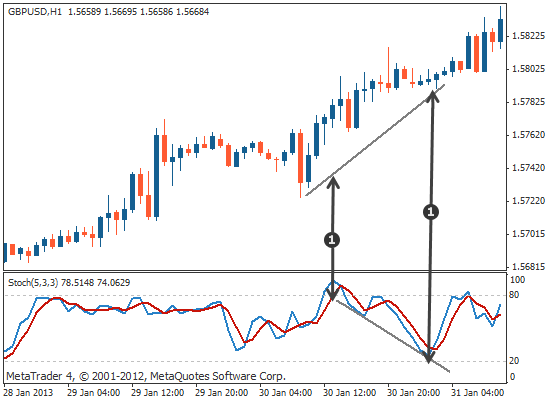

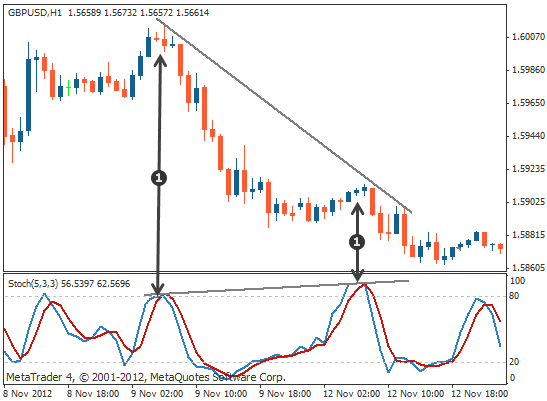

A divergence forms on a trader’s chart when the price makes a higher high and the indicator makes a lower high.

It’s strategies can help traders identify potential areas of support and resistance, recognized trend reversals and better time their entries and exits by recognizing the divergence between the pride action and the underlying momentum, traders can gain an edge in the market. This strategies can also help traders reduce their risk by limiting their exposure to high risk trades and helps them focus on trades that are more likely to end in a profitable outcome.

Types of Divergence

- Classical Divergence (Regular)

- Hidden Divergence

Classical Divergence is formed when the price is making a lower low But the indicator is making a higher low, Or when the price makes makes higher high both the indicator is making a lower high. There are two types of classical divergence;

- Bullish classical: This signal is generated when the price makes a lower swing low and the indicator makes a higher low.

- Bearish Classical: This is generated when the price makes a swing high while the indicator is making a lower high.

Hidden Divergence

Hidden divergence occurs when the price of an asset carves a higher low, while the indicator creates a lower low. There are two types of hidden divergence

- Bullish hidden: It occurs when the price of an asset makes a set of higher lows and the indicator simultaneously makes a series of lower lows.

- Bearish hidden: It occurs when price action makes a lower high but the indicator alternatively makes a higher high.

Benefits of Divergence Trading

- Reduces risk: It reduces the risk of trading because it helps identify potential turning points before they occur by identifying market is turning, traders are able to adjust their trading strategies accordingly to maximize Losses and maximize profits

- Profit potential : It has the potential to generate large profits when the market turns. By correctly predicting when a trend is about to reverse, traders can take advantage of the price movements to generate returns.

- Increased confidence: By using this trading, traders are able to have more confidence in their trades as they have identified potential turning points before they occur. This can reduce the fear of trading and allow traders to stay in trades for longer periods of time.

- Market Insight : It gives traders a better understanding of the markets, allowing them to make better trading decisions. By using it, traders can better understand trends and market dynamics allowing them to make more informed decisions.

If you’re in the mood for more trading education, Check out our other article on autotrading here.