Mortgage rating is a system that helps a lender determine if a borrower is worthy of mortgage and how risky such a borrower is. Factors like credit score, income, debt to income ratio are all indicators of the borrower’s ability to repay the loan. The higher a borrower’s mortgage rating, the lower the risk of default and the higher the probability of getting approved for a mortgage. It is similar to a credit score as it determines if a borrower gets mortgage or not.

Why Does Mortgage Rating Matter?

As a lender, here are a few reasons why the mortgage rating of a borrower is important.

It helps lenders determine how risky a borrower is:

No lender wants to invest in a borrower who cannot pay back or who does not have a property that equals what they have been borrowed. This is why its important to lenders that a borrower has a good mortgage rating that covers the initial mortgage and possible interest on the mortgage.

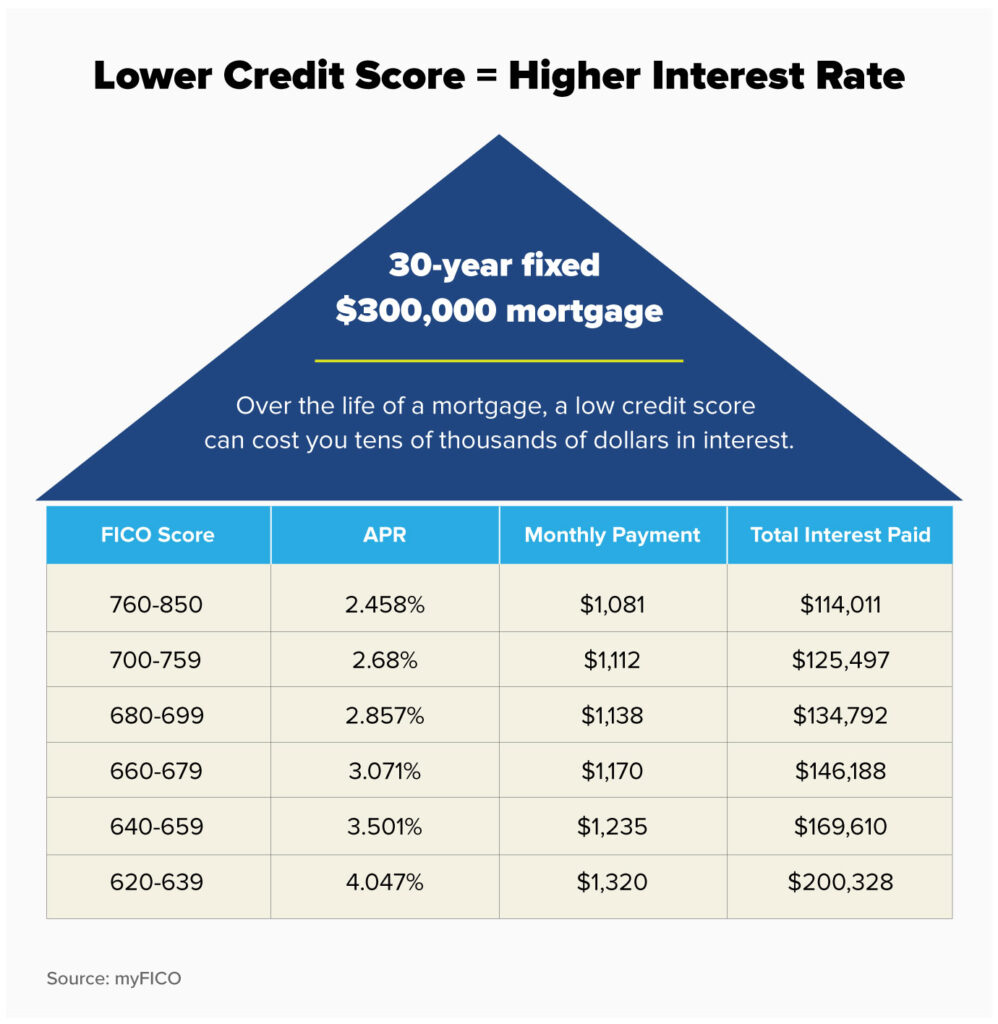

It affects the interest rates and the fees associated with the loan:

A borrower’s mortgage rate could impact their interest rate or fees associated with their mortgage loan. This means that when a borrower’s mortgage rate goes up, the interest and associated fees goes up. And on the flip side, when the mortgage rates of a borrower nosedives, the interest and fees associated nosedives as well.

It helps lenders determine the likelihood of default:

As a borrower is unfamiliar to the a lender when applying for a loan, the only metric to go by for a lender is the mortgage rating. This being said, when a borrower has a low mortgage rating , it sends a message to the lender that they might have a tendency to default.

On the other hand, if the borrower has a higher rating, it sends a clear message that the borrower is credible.

It helps assess the risk of foreclosure:

It helps by providing an objective, quantitative measure of the default risk associated with a particular loan. Mortgage ratings assign a score to each loan based on factors such as the borrower’s credit history, financial resources, loan-to-value ratio, loan term, and other factors. These ratings can help lenders determine which loans are more likely to default, and which loans are less risky. They can also help investors understand the relative risks associated with different types of loans.

It helps lenders determine the amount of money a borrower can borrow:

A borrower with a low mortgage rating would not be given a mortgage of a million dollars even if he applied for it, But a borrower with a higher rating would be afforded this kind of mortgage in an instant.

What does this mean? It helps lenders determine the cap on the mortgage a particular borrower can take.

It helps provide additional information on the borrower:

Mortgage rating provide lenders with all the information they need to grant a borrower mortgage. As lenders and borrowers are not familiar with each other, the borrowers rating lets the lender make correct choices on whether the mortgage should be given to the borrower or not.

Mortgage lenders use rating to estimate the risk of a borrower defaulting . A borrower with a higher rating is good business for a lender whereas a borrower with a low rating is bad for business.

As a borrower,How do you ensure good mortgage rating?

- Get pre – approved for a mortgage: Getting pre – approved for a mortgage helps you get a good mortgage rating. How it helps is that it lets you know how much you can borrow and what interest rates you qualify for.

- Make a large down payment:

Making a large down payment means you have to borrow less money when applying for mortgage and could even help your finances in the long run.

As an added benefit, you get a good mortgage rating.

- Have a good credit score rating:

Having a good credit score(680 or higher) is one of the surefire ways to ensure you get a good mortgage rating. Equally, it is important to make sure bills are also paid on time and that not much debts is owed.

- Have a low Debt to interest ratio (DTI):

Having a low debt to interest ratio is important .A low DTI ratio means you handle your finances expertly and shows lenders that you can handle your mortgage payments.